One of the most well-known data metrics that marketers and SEOs have relied to make informed decisions is search volume. Despite its popularity, one constant question remains: “What is the true search volume?”

Following years of frustration with Google Keyword Planner's unreliable search demand data, answering this question has only become more complicated with the rise of AI search.

In fact, our research suggests informational “seeking” activity on ChatGPT alone now exceeds ~1 billion search-like tasks per day, illustrating that a huge portion of demand happens outside traditional SERPs.

This fragmentation requires a broader view of demand that reflects user intent expressed across platforms, not confined to just one search engine’s data.

Below, I'll address eight significant drawbacks of traditional search volume data and unveil how True Demand and Clarity ArcAI sweep them all aside.

Table of Contents:

What is Search Volume?

Search volume is an estimated measure of how often users search for a specific query, traditionally based on activity within a specified search engine over a defined period of time.

Google’s search volume data comes from Keyword Planner, a tool built for Google Ads and PPC planning. While SEOs rely on it to infer relative demand, it reflects activity from a single search engine and a specific advertising-driven dataset—not the full landscape of how users search today.

Other search engines and AI-powered search experiences capture intent differently, and most do not publish search volume data at all.

To help address this gap, Clarity ArcAI estimates AI search demand by modeling how users seek information across AI-powered search experiences and translating that activity into an estimated monthly search volume by topic. We’ll explore this in more detail later in the post.

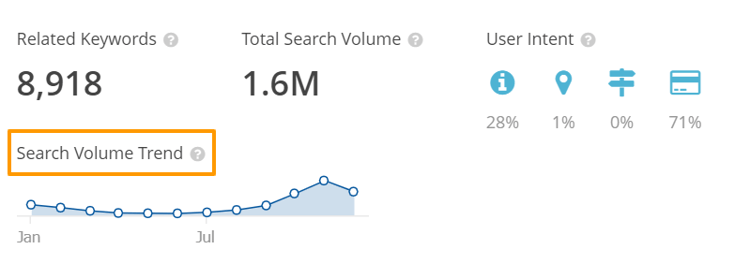

Types of Search Volume

There are two different kinds of search volume estimates. The first is average search volume, which is the average of the past 12 months’ worth of search volume numbers.

This version of search volume is the default metric reported in the Adwords Keyword Planner.

The second type of search volume is monthly search volume. This method and metric is each keyword’s search volume listed individually by the month.

This approach can be great for identifying trends in seasonality, since different months will have different highs and lows depending on major events, holidays, etc.

Recommended Reading: Why to Trust Weighted Average Rank Over Average Rank

Take a look at the chart below, for example. This is the search volume for the keyword “winter jackets” in our Topic Explorer.

The term has little to no demand in the summer, and an increase in demand that starts in September leading into the winter months.

(Search volume for the keyword “winter jackets” in Topic Explorer)

The Drawbacks of Search Volume

Traditional search volume data may seem precise and trustworthy due to its prevalence, but there are many drawbacks that you need to know.

These problems, after all, could have a large effect on your overall SEO strategy.

#1. There is No Correlation Between Search Volume and Traffic

You’ve probably been in this situation yourself: you’re conducting keyword research and tag those with the highest search volume to go after.

After all, if there is more demand for those keywords, that should translate into more traffic, at least in theory

However, high search volume does not guarantee high traffic. Especially with the rise of zero-click searches, where users can find the relevant information they need directly on the SERP.

Our CTR Study shows that even top-ranking pages capture a shrinking share of clicks for informational queries because, most times, AI Overviews answers the question directly in the SERP.

But just because a query has a low search volume does not mean it isn’t worth targeting. Low search volume does not guarantee low traffic.

Plus, you still want to build your content cluster around a main topic to prove your topic authority on the subject matter as a whole, so don’t dismiss small search volume keywords. (more on this below.)

#2. Search Volume is a Sampling of Billions of Queries

As previously mentioned, search volume is a very broad estimate.

But how broad, exactly?

Search engines use an exceptionally small sampling (3% based on Google's knowledge base) of the billions of queries that take place on their search engine to estimate the search volume.

It is in no way an accurate representation of true search volume.

#3. Adwords Combines Keywords, Even if Those Keywords Have Different Search Intent

Search volume has no understanding of the context behind search queries – it’s a purely quantitative metric.

For example, consider the query “apple.” Does it refer to apple.com, information about the fruit, images of apples?

Of course, the searchers themselves know, and those potential meanings are vastly different search journeys.

So although the search engine tries to understand search intent and present relevant information, the search volume estimate has no understanding of this, and will group all different intents into one number.

Search intent informs the type of content that you should create to target customers along their respective search journeys.

Being limited when it comes to search volume and its relation to search intent creates roadblocks and confusion, and yet again reinforces the fact that traditional search volume estimates aren't accurate.

#4. Information for Brand New Keywords Will Be Skewed

When dealing with average search volume (data of the past 12 months) there is inherently going to be some issues when new queries arise throughout the year.

If a product was launched in December, for example, the search volume would be much lower than it actually is, simply because there were no searches for that (at the time, non-existent) product for the past 11 months.

Consider the iPhone 17. Released in September 2025, there were not too many searches prior to this date (besides perhaps searches made speculating about product release dates and features).

After its release, searches for this product surged, but since there were 10 entire months with little to no searches, the average search volume skewed low.

Tip: In this situation, look at monthly search volume instead to get an understanding of the searches on a month-to-month basis.

#5. Search Volume Cannot Be Sorted By Device Type

It’s not enough to create a list of keywords and track them – knowing which device the search occurs on is arguably just as important as the search itself.

You cannot forget about the push toward mobile as websites continue to become mobile-friendly and the amount of mobile search users continues to rise.

Unfortunately, search volume cannot be categorized by device type, which limits your understanding of how the user conducts the search.

#6. Google Shows the Same Search Volume for Variations of the Same Keyword

Google groups similar variations of keywords together which can lead to ill-informed decision making for your team. Let’s take a look at an example.

The keywords “pricing of iphone x,” “price iphone x,” and “price for the iphone x” may all have different search volumes, but since Google lumps them together and presents the same search volume for all of them, we’ll actually never know – even though that information could help inform your SEO strategy.

#7. GSC Data Does Not Match Google Ads Data

This may be the most telling sign that Google's search volume metric is inaccurate: Google’s own data contradicts itself!

Google Search Console reports impressions and clicks based on real user interactions in organic search, while Google Ads (formerly AdWords) provides modeled keyword search volume estimates intended for paid media planning.

In practice, these two datasets often tell very different stories for the same query. SEOs routinely see scenarios where Search Console reports significant impression volume for keywords that Google Ads labels as having “low” or even zero search volume (or the reverse).

This inconsistency makes it difficult to trust search volume as a stable measure of demand, especially when one source reflects observed behavior and the other relies on sampling, aggregation, and commercial modeling.

#8. Google Hides Search Volume for Certain Keywords

Google sometimes hides search volume for certain terms for legal reasons, privacy concerns, or issues with their policies.

If you search for something that Google doesn't allow bidding or advertising on, it won't show any search volume for that term.

This includes things like weapons and drugs, and is sometimes the case with pharmaceutical drugs.

The lack of data creates problems for companies in those industries (casinos and gambling, for example), where certain terms may show as not having any search volume.

You may know that these terms do indeed drive traffic to your site, and that impressions show on Search Console, but search volume data is not there.

This situation only affects about less than .5% of all keywords, but this is a real challenge if you work in one of these industries.

When you see a search volume of 0 when you expect it to be in the thousands, for example, your forecasting models, estimations, and ability to invest are all impacted.

#9. Traditional Data Ignores "Prompt Volume"

Google Keyword Planner measures traditional search demand, not how users phrase questions in AI tools.

It cannot see what people are asking ChatGPT or Gemini in conversational search environments.

This creates a significant demand blind spot for SEO teams.

AI search engines do not publish prompt volume or impression data. As a result, many high-intent questions never appear in keyword research tools.

SEOs must map real user questions across topics and entities instead.

This approach uncovers demand that search volume alone fails to reveal.

The Solution: Measuring Traditional and AI Search Demand using seoClarity

Search Volume for Traditional Search

Given the many challenges of Google's keyword search volume data, we sought to create a solution that would provide our clients with access to fresh, up-to-date search volume.

True Demand estimates average monthly searches using clickstream data, including queries Google Keyword Planner often obscures.

This is completely GDPR compliant with fully anonymous data collected from billions of real user searches.

The clickstream data allows us to create a statistical modeling to calculate these estimated search volume trends. This allows for more specificity in the search volume estimates, as opposed to the broad ranges that Google provides.

(Search volume estimates for a relatively new topic.)

(Search volume estimates for a relatively new topic.)

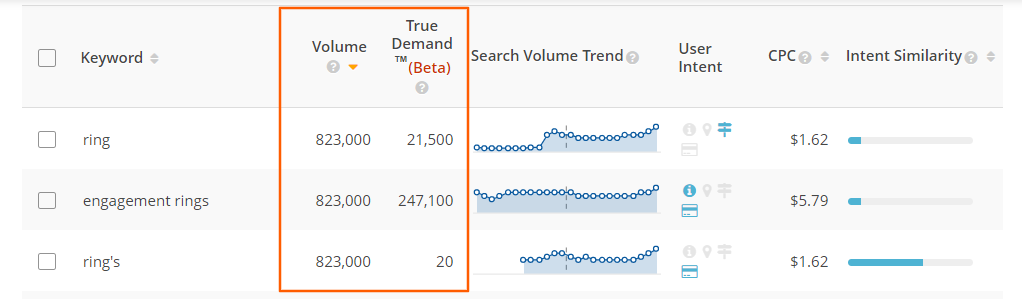

You can even compare search volume from Keyword Planner directly next to True Demand.

Look at this example of search demand from Keyword Planner compared to True Demand estimates:

(True Demand in seoClarity's Topic Explorer.)

While Google groups rings, engagement rings, and ring's together (all with the same search demand), True Demand uses clickstream data to get more specific.

Note: All search volume is an estimate. It's meant to be used directionally, so you can prioritize between search terms.

Estimating AI Search Demand for Prompts

Google Keyword Planner cannot measure what users ask AI search engines such as ChatGPT or Gemini.

As an added challenge, these platforms do not publish prompt volume, search trends, or impression data. To give you the data you need, Clarity ArcAI Explorer provides valuable insight into how AI search engines interpret and group user questions.

It reveals recurring prompt patterns and topic relationships that reflect AI search demand signals.

This allows you to see estimated AI search volume for any topic as well as the real prompts users enter.

From Keywords to Topics

It's important to be aware that you shouldn’t always be working query to query, search volume to search volume.

Focus on creating clusters around your main topics. This topic cluster approach proves your complete authority in the subject area.

With Topic Explorer, you can understand a searcher’s journey and find missing content. Then, build out that content to grow your cluster and have a piece of content for every stage of the buyers' journey, no matter what the intent is.

Plus, Topic Explorer makes it easy to do this, with the ability to narrow down our keyword database by industry, and see how people really search with Keyword Patterns.

The example below shows potential search query variations related to the keyword “iPhone X” that can inform your content marketing strategy.

(Keyword Patterns in Topic Explorer.)

Topic Explorer also allows you to filter down the keywords by keyword length. So, for example, you can specify that each keyword be greater than 2 words to find long-tail keywords.

Build out your content centered around long-tail keywords to start becoming an authority with your clusters, and then start to go after high search volume keywords.

Conclusion

Search volume alone no longer reflects how people discover information.

AI-generated answers, zero-click SERPs, and hidden prompt behavior have changed how demand shows up in search.

SEOs must look beyond keyword search volume to understand real user intent and visibility opportunities.

Combining traditional demand signals with AI search insights leads to better prioritization and stronger outcomes.

If you want to see how this works in practice, schedule a demo to explore True Demand and Clarity ArcAI.

<<Editor's Note: This piece was originally published in March 2020 and has since been updated.>>

Comments

Currently, there are no comments. Be the first to post one!