Google Dominates Apparel Search Results [Research Included]

An analysis of ~150,000 apparel-related keywords

By Mitul Gandhi, Chief Architect & Co-Founder of seoClarity

By Mitul Gandhi, Chief Architect & Co-Founder of seoClarity

Competition in organic search extends beyond other sites and businesses—websites increasingly compete with Google’s own properties like Google Shopping, Images, Flights, Hotels, Maps, and more.

For the purposes of this industry study, we took a deep dive into nearly 150,000 apparel-related keywords. With the upcoming holiday season, we wanted to understand the competitive landscape in the SERPs and the challenges and opportunities that exist for apparel retailers online.

Like most, we expected to find the SERPs dominated by large eCommerce sites with a spattering of SERP features.

What we found was surprising. Across 150,000 apparel-related keywords we found more than 95% of the keywords triggered a SERP feature within the first 10 results.

But that’s just the tip of the iceberg...

The frequency of the Popular Products pack is even more shocking with 85% of the keywords triggering that result.

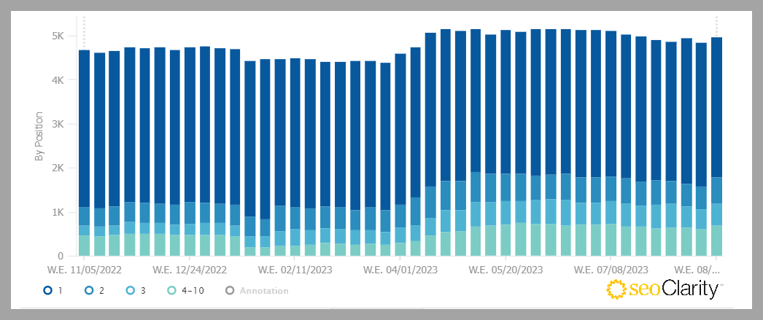

(Frequency of ‘Products Carousel’ on apparel on the SERP.)

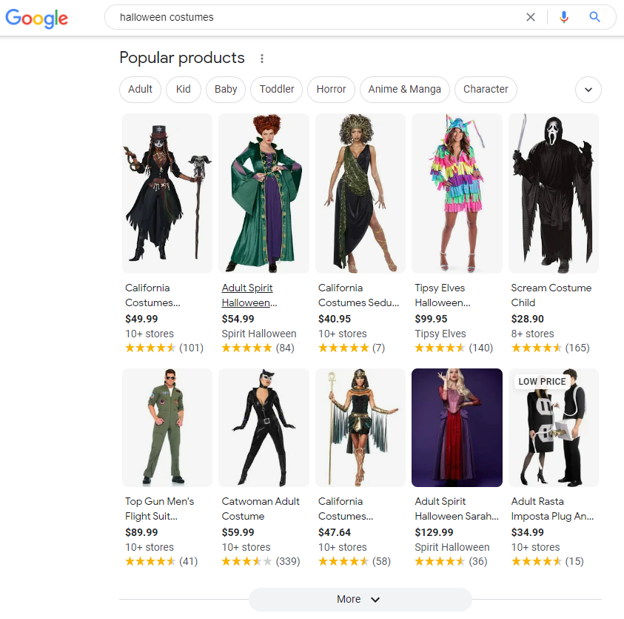

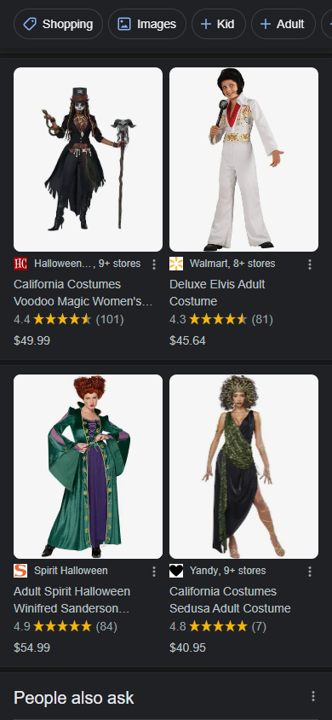

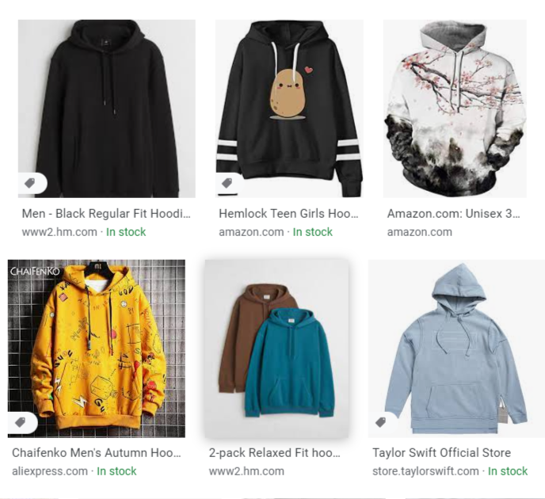

The latest iteration of the Popular Products pack looks something like this on desktop:

Notice the size? On a 1920x1080 resolution screen, that fills up nearly the entire screen.

That is the equivalent of 5 regular web results! Those are displaced and pushed further down.

And, the experience is similar on mobile, taking over an entire scroll view.

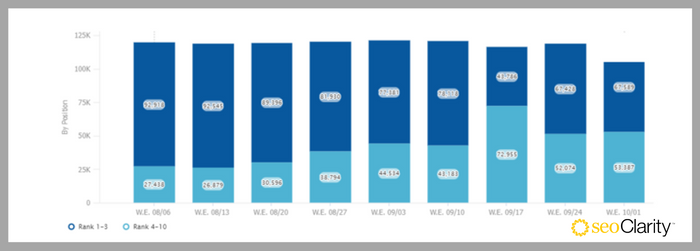

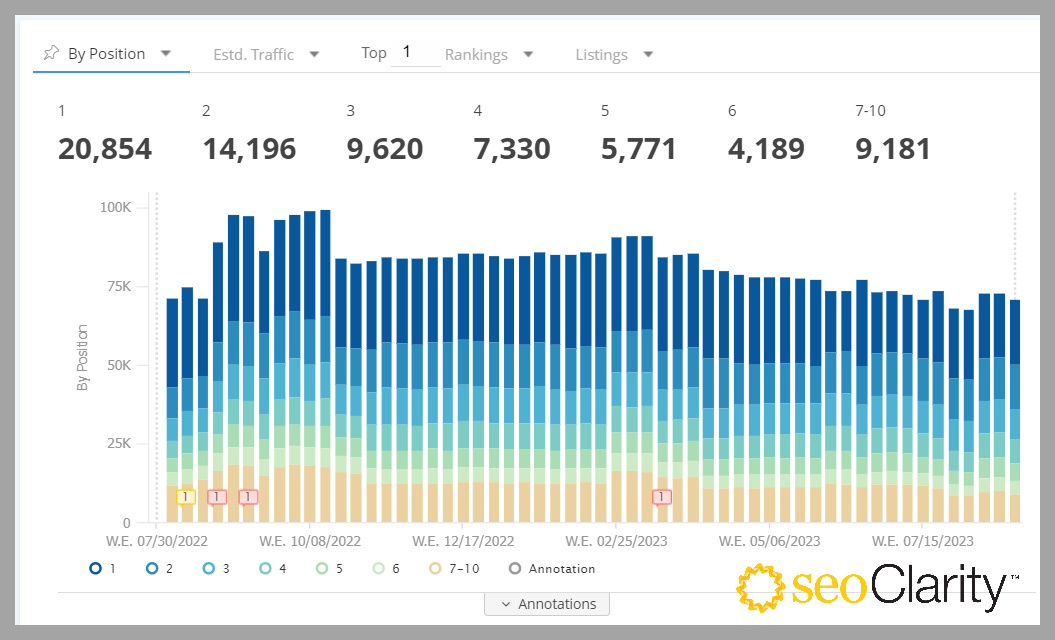

If you are an apparel retailer online and seeing:

and / or

... those two phenomena may be related!

Organic website specific listings have lost significant visibility to Google’s Product listings (and other SERP Features). Tweet

Before anyone thinks that this means SEO is dead, we would propose instead that SEO has expanded.

The goal for SEOs and retailers should be to win in both the regular web listings AND the Product listings—expand efforts beyond tracking, optimizing, and reporting on web pages to also include product feeds.

While there could be some cannibalization between the two, winning more SERP real estate is still incrementally better than doing well on just one of the two.

With seoClarity, you can track, manage, monitor, and optimize for Google Shopping and products feeds.

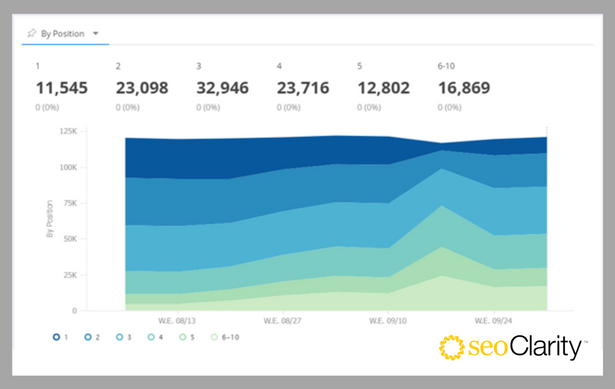

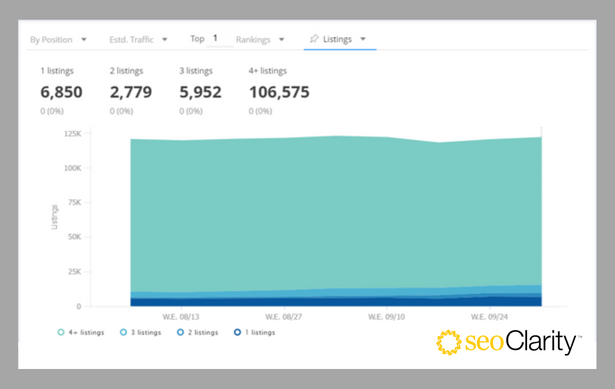

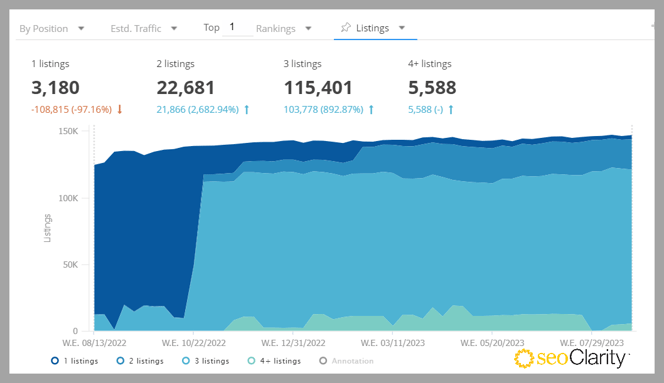

48% of the keywords had a Popular Products pack in the top 3 listings for apparel queries.

On mobile, 75% of apparel-related queries triggered 4+ listings. This is incredible opportunity. If you aren't optimizing for Google Shopping, your organic search traffic and visibility is stifled.

On desktop, the story isn't much different. About 88% of the queries' SERP only had two or more Popular Products listings.

As more and more people go to specialized search engines like Amazon, Home Depot, or Best Buy to shop, Google is at risk of losing market share for queries that are closest to transactional intent: product searches.

In fact, 61% of online shoppers in the United States start their product search on Amazon, according to a May 2022 study conducted by Jungle Scout and distributed by Insider Intelligence.

Google has evolved its strategy for the SERP over time for transactional queries related to products. PPC ads were soon joined by Google Shopping, Google Images, and free product listings.

(Google Images offers a direct purchase point to consumers with the intent to buy.)

In fact, Google abandoned its free product listings offering back in 2012 and replaced it with a paid listing option.

At the start of the pandemic, everything changed. It quickly reintroduced the free listings option and since then has carved out significant real estate in the SERPs for the same.

This move also meant that Google could give users a direct path to purchase as opposed to having them start off at a site like Amazon and bypass them altogether.

Google’s self-promotion is here to stay and with it, the cannibalization of regular web results.

Nonetheless, SEOs can still drive incremental traffic and optimize their product feeds submitted to Google.

seoClarity provides enterprises a scalable way to optimize track, measure, optimize, and report on their performance within Google Shopping.

Recommended Reading: Google Shopping SEO: How to Drive Organic Search Traffic

The search engine has long moved to monetize different segments of search. Remember the days of the 10 blue links? Those days are long gone.

Paid search ads and the rise of the local pack were the first to give Google entities more visibility in the search results, as were specialized search engines like video and images.

This was soon to be followed by Google Flights, Hotels, Jobs, and others.

Interested in a deep dive on the history of Google’s Monetization push? Take a look our recent article about Google's monetization.

Then there are local listings, which don’t appear as often. After all, Google’s algorithm has evolved and understands when online apparel shopping is distinct from intent to shop offline.

With only ~3% showing a local listing result in the top 3 positions, it seems that Google’s algorithm learns that when people search for apparel-related terms, there is a lower probability that the user is looking for a location.

However, when it does show up, it’s most commonly in position 1 at 74% of the time.

Out of the 150k keywords we analyzed, Images showed up in the top 10 results 38% of the time with most frequently showing in positions 1-3.

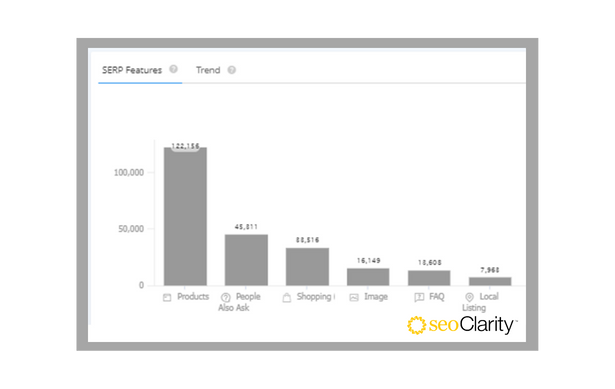

These are the most common SERP features for apparel-related keywords:

| Products Carousel | People Also Ask | FAQs | Local | Images | Free Product Listings |

| 120,772 | 57,925 | 17,119 | 8,563 | 2,451 | 877 |

Research data and insights were compiled using the seoClarity platform.

We tracked 142,004 apparel related keywords over a 6-week period to understand trends and to prevent anomalies in the insights within this research.

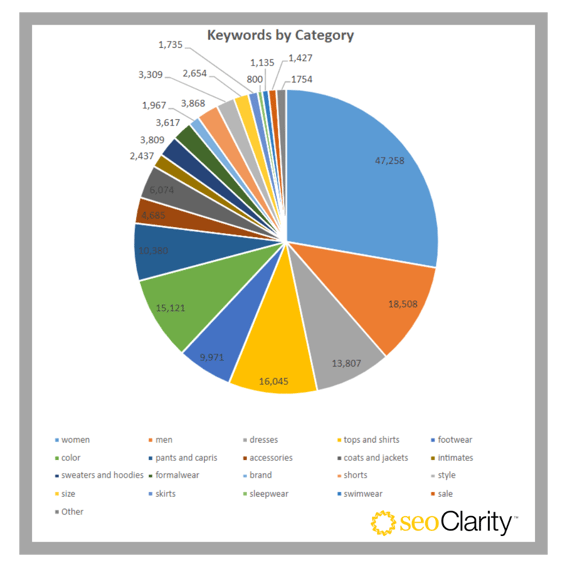

These apparel keywords made up a total of 263 million searches per month. The breakdown of sub-category of those keywords is listed in the next section "Research Findings by Sub-Category".

All reports and findings were based on the Google Mobile results daily keyword tracking in the United States from August 24, 2022 - October 1, 2022.

Updates made in September 2023 for any changes in the percent of SERP features showing.

We looked at the most popular queries in apparel—a whopping 150,000 keywords with a combined ~263 million searches per month and broke them down by sub-category.

See how these Google SERP features perform in each category of apparel.

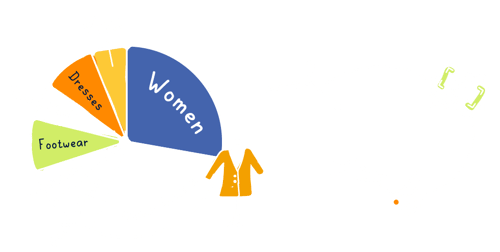

(Distribution of Keywords by Sub-Categories Analyzed in this Study)

The apparel industry can be segmented into a number of different categories. From women’s to men’s, dresses to footwear, and shorts to swimwear.

We looked at the following categories and pulled insights for each segment:

|

|

The women’s category far outnumbers all the others. It’s more than twice as large as the second largest category, men’s.

Amazon dominates the women's category, followed by department stores like Nordstrom and Macy's.

After all, Amazon has an extensive collection of keywords. For example, Amazon has more than 40,000 products for "black dress" compared with less than 2,000 products at Macy’s and fewer still than Target’s 1,000.

All these sites have comprehensive keyword portfolios. That means they all target a combination of high volume and long-tail keywords.

Amazon dominates the men's category as well.

However, Kohls — a more cost-effective clothing option — cracks the top five for the men’s category. Target, on the other hand, holds a top spot for the women’s category.

Kohl's, similar to Amazon, Nordstrom and Macy's, utilizes a mega menu in the navigation bar, whereas Target does not.

Similar to the women’s category, all of these sites have comprehensive keyword portfolios.

.png?width=159&name=Mitul%20Gandhi%20-%20Author%20Snippet%20(1).png) About the Author: Mitul Gandhi

About the Author: Mitul GandhiAs a longtime data-driven serial entrepreneur, information architect and SEO veteran, Mitul has developed a blend of vast technical expertise and intense marketing insight. His variety of experience, gained in positions in in-house SEO, search marketing, and software development, affords him the ability to efficiently assess how to use software tools to meet challenges and drive ROI. As the Co-Founder and Chief Architect of seoClarity, Mitul currently oversees day-to-day operations, and provides strategic direction to all departments. His well of knowledge includes 10+ years of consulting experience with Fortune 500 and top Internet retailers concerning online search marketing. He has several patents pending for analyzing cause and effect in SEO. Mitul holds an MBA in direct marketing from Rochester Institute of Technology. Additionally, he has spoken at conferences in the United States and the U.K., including SES, SMX and PubCon. He has also been quoted in MSN Money, USA Today, Time Online, Search Engine Watch, Search Engine Land and Web Pro News. Connect with him on Twitter or LinkedIn.